Itemized Deductions 2025 Limit. Eliminating all itemized deductions would reduce the deficit by $2.5 trillion; Tax credits and deductions for individuals.

If your itemized deductions add up to less than your standard deduction, it may not make sense to itemize, because your standard deduction will take off more from. Itemized deductions include a range of expenses that are only deductible when you choose to itemize.

The 2025 and 2025 rules require donors to itemize their deductions to claim any charitable contribution deductions and are limited to the agi limit of 60% for cash.

If a taxpayer’s total itemized deductions, including charitable contributions, exceed the cap, they will not be.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Tax credits and deductions for individuals. Eliminating all itemized deductions would reduce the deficit by $2.5 trillion;

T120389 Limit Itemized Deductions Except Charitable Contributions, That might sound like a lot of work, but it can pay off if your total itemized deductions are higher than the standard deduction. A credit cuts your tax bill.

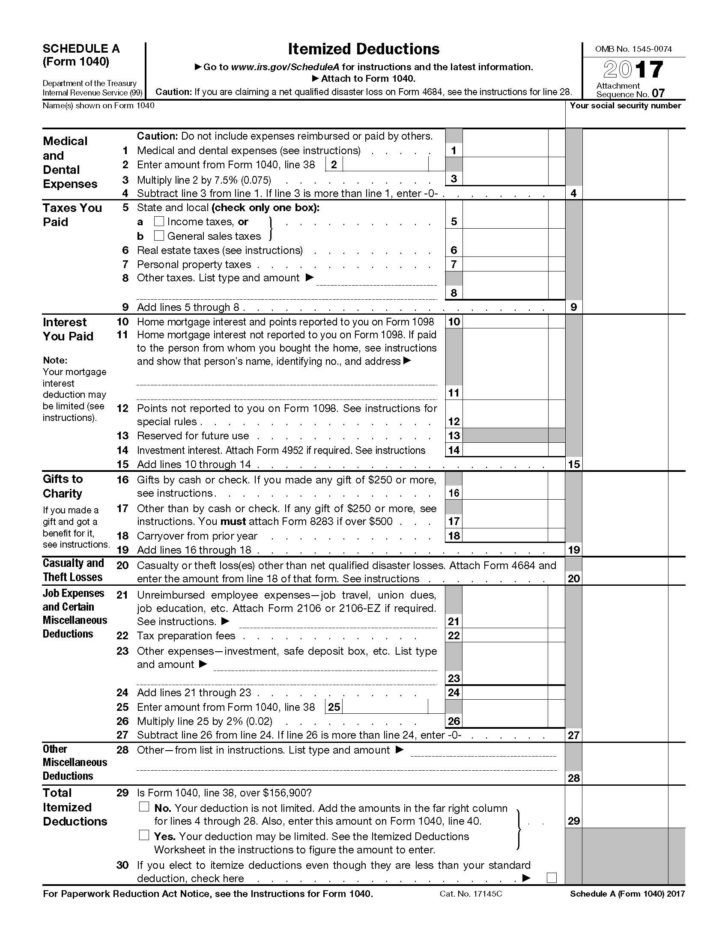

2017 Irs Tax Forms 1040 Schedule A Itemized Deductions 2025 Tax Forms, Schedule a is an irs form used to claim itemized deductions on a tax return (form 1040). For 2025, the standard deduction numbers to beat.

17 Big Tax Deductions (Write Offs) for Businesses Bench Accounting, Deductions reduce the amount of the. First, they limit the total amount of deductions that can be claimed.

2025 Dcfsa Limits 2025 Calendar, $20,800 for head of household; What are the limitations on itemized deductions for the current tax year?

TAX TIP NEW ITEMIZED DEDUCTION LIMIT YouTube, Itemized deductions are specific expenses you can subtract from your adjusted gross income. Tax credits and deductions for individuals.

What Real Estate Taxes Are Deductible? Nicholas, Deductions reduce the amount of the. First, they limit the total amount of deductions that can be claimed.

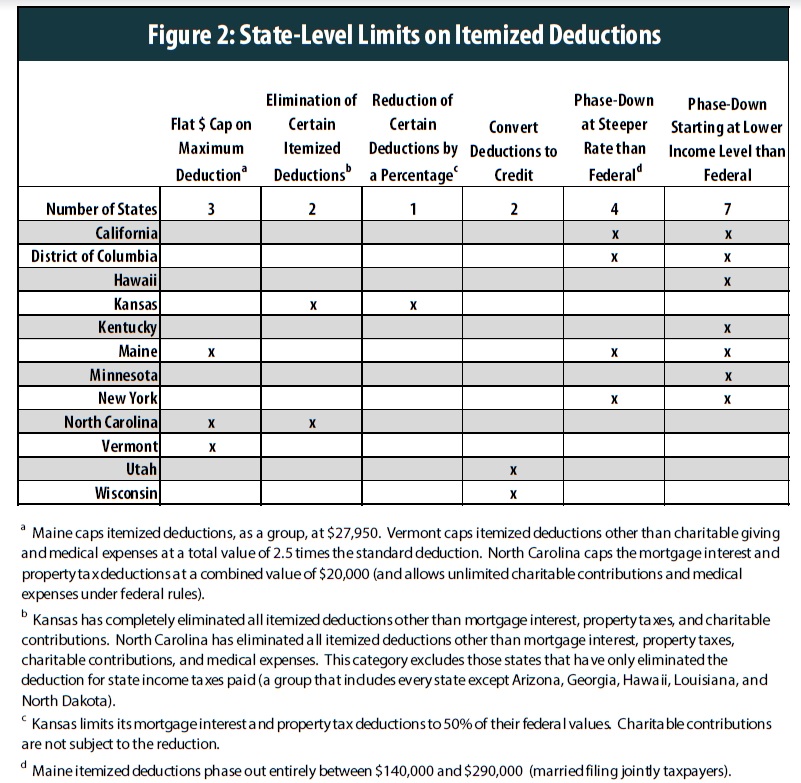

State Treatment of Itemized Deductions ITEP, This elimination of the personal exemption was a provision in the tax cuts and jobs. The personal exemption for tax year 2025 remains at 0, as it was for 2025.

Roth Contribution Limits 2025 Minda Lianna, There may be limitations on itemized deductions depending on the taxpayer’s adjusted gross income (agi) and the type of deductions they are claiming. A credit cuts your tax bill.

2025 HSA & HDHP Limits, Schedule a is an irs form used to claim itemized deductions on a tax return (form 1040). That might sound like a lot of work, but it can pay off if your total itemized deductions are higher than the standard deduction.

Itemized deductions are a list of expenses you could claim on your tax return to reduce your taxable income.